By Darren Shirlaw, Founder of Shirlaws Global

“Current conversations are often about surviving the recession, but this misses an important point. It’s too late to think about survival, and just the right time to be planning for economic recovery”, says Darren

The Great Recession

While the so-called Great Recession focused everyone on survival, many businesses failed to appreciate their own stage in the business cycle. This understanding will help you plan for economic recovery by matching your business stage when preparing for growth.

For cyclical growth, businesses must continually build their infrastructure platforms and invest hard. Ideally, you want your business to be in a growth stage just as the economy is recovering. If your business is still building new infrastructures at this time, then you’ll miss out.

Good times…to stress times

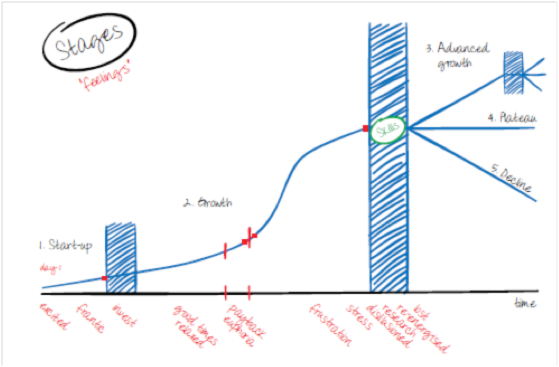

The easiest way to understand this concept is with reference to the Stages Model, where brick walls represent a company’s ‘platform-building’ phases. Typically, businesses experience healthy growth between the first and second brick wall.

They report good times of healthy, but incremental, annual growth. Then the business hits payback, when business owners say, “We’re doing really well!” During this stage, the business is typically cash-rich, with higher revenues and returns than the owners originally thought possible. But there aren’t too many businesses in payback right now.

Following payback, business owners usually find themselves having to deal with day-to-day matters such as staff, overheads, debts and client servicing. These pulls on their time now take owners away from acquiring clients and into daily management instead. Enter frustration, which eventually leads to stress.

At this stage the business needs major restructuring, and new ‘platforms’ such as client servicing programmes, to enable more growth. We call this stage the second brick wall. People often find that once they’ve gained clients during good times,  the necessary infrastructures aren’t in place to service them – and the investment may be lacking.

the necessary infrastructures aren’t in place to service them – and the investment may be lacking.

Recessions often fast-track businesses into this second brick wall by reducing client numbers and increasing staff issues, including redundancy.

The owner now has to deal with debtors, creditors and cash flow problems. Suddenly, they move from a client focus to dealing with the mess in their back office. Stress kicks in for the owner who thought they were doing so well in 2007. By 2012, the same owner has been catapulted into their second brick wall.

Advanced growth

Hitting your second brick wall during a recession is the right time to start planning for recovery. We’re now seeing more businesses in this situation and smart owners are trying to time their entry to advanced growth with economic recovery. The simple message is one of timing.

Normally, businesses spend three to seven years in their second brick wall as the economy moves gently along. They don’t have the additional pressures of too few clients, difficult sales or lengthy processes because they’re supported by a strong economy.

Right now your business cycle, and journey through that brick wall, isn’t being supported by the economy. If we assume the economy will experience a double dip recovery, we haven’t got the normal seven years to transit the brick wall.

This is because every other W-shaped recession has been over in about three years. Theoretically, we could be into recovery in one or two year’s time.

Fast-tracking for advanced growth

If you’ve just entered your second brick wall, you’ll need some fast-tracking to prepare for economic recovery. Now the pressure is on to get out of that wall and into what we call advanced growth – the gap between the second brick wall and the third.

Advanced growth is the most productive stage. It’s when your business makes the most money and increases its equity valuation. It’s also when the business owner is the least bogged down in day-to-day management and probably the time they most enjoy. During payback you were getting good money from the business, but it was still very reliant on you.

In advanced growth, you’ll still get good money, but the business isn’t so reliant on you and therefore the enjoyment is significantly higher. If you can time advanced growth to coincide with economic recovery, then you’re on to a winner.

If the economic recovery kicks in and you’re still restructuring your second brick wall, then you’ll miss an essential opportunity.

Key business actions to get through the second brick wall – fast

The first two activities on this list deliver the critical platforms most businesses miss, while the next three activities leverage your business for advanced growth.

1. Capacity management. Identify the manageability of your production process in capacity terms. This applies whether you’re a service or manufacturing company and ensures smooth transition from one growth platform to the next.

2. Capability management. Recruit people with the right capabilities to release the business owners.

3. Position. Create product positions for your business operation, which is where product innovation and IP development kick in.

4. Channels. Find new, fresh product channels to market. Consider exploiting new market niches you didn’t explore in the previous boom.

5. Succession strategy. a) Internal succession: bring through new staff who will release the owners. b) Equity succession: enables business owners to take some money off the table. Entering advanced growth without succession planning usually means owners become stuck. This happens when they can’t bring capable staff through because their equity structures aren’t attractive. The absence of a succession strategy usually results in the business entering a plateau phase, or even decline, instead of advanced growth.

Manoeuvring through flat lands

Some theorists worry the economy will go into an extended flat phase – so no real recovery. But an inherent recovery always lurks inside a flat phase.

A flat economy simply means less GDP growth than during a boom and the flat line is essentially an average of many business ups and downs. Under this macro flat line is the micro business situation where some businesses are stalled and some are in decline – but some are booming.

A flat line economy doesn’t mean everyone is flat-lined. For all the companies going backwards, some have gone forwards. The way to manoeuvre through a flat phase, at an early stage in economic recovery, is through micro-niche marketing. Find your product niche and get it out to the booming parts of the market. Identify who has the cash out there and go get it.

Remember that while the average employee probably hasn’t had a pay rise, their cost of living has reduced enormously. Mortgage rates and retail price reductions through sales events have all improved their net position – meaning more cash available for products and services.

Clear market position

Creating a clear position around your markets is essential right now and effective descriptions will attract customers. Broad statements such as, “We sell Brand X” isn’t good enough. You must have focused statements such as, “We sell Brand X to Generation Y.” Find your niche and sell into it.

Armed with this approach, you don’t have to be one of those flat line businesses. You can have an advanced growth business instead.

Saying, “We’re still in a recession” will tether you to the past, because the Great Recession only lasted until 2009. The Big Down is now over. But even if the economy double dips, the second dip will simply go down and then climb into recovery. Bringing on the double-dip would almost be a blessing because we could then predict the timing of the boom.

Draw a line and move on

Stop worrying about the last few years and face the market with a positive construct. Draw a line in the sand and start looking forward from today to see what’s coming in the future. Taking that approach will energise your business – and you – ready for advanced growth.

Lots of businesses have been pushed into the second brick wall by the Great Recession. Maybe you’re one of the many restructuring your organisation right now. If you are, just restructuring the staff, P&L and cash flow isn’t going to be enough for you to take advantage of the next boom.

Timing is everything!

Adapted from Shirlaws ebook – A guide for every business owner to Thrive, not just Survive through the biggest depression in 100 years.

About the Author

Darren Shirlaw is the founder of one of the fastest growing international business coaching organisations. Established in 1999, Shirlaws now operates in 34 countries.

Prior to setting up Shirlaws, Darren spent nine years in the Fund Management industry, gaining valuable insight into how businesses build equity value. During this time, he recognised a gap in the consulting marketplace. It was dominated by large corporate consulting firms who serviced large corporate clients, while the balance of the consulting marketplace was fragmented with many small operators, mainly working from home with few resources.

In 1994, aged 29, Darren worked with his first ‘test crash dummy’ client, to trial his coaching services. Four years of research later, the first Shirlaws coaching product had been built and today they service over 620 Corporates and High Net worth Entrepreneurs.

Darren is responsible for developing the organisation’s unique business model and much of its IP, in the form of a portfolio of coaching frameworks that address key issues faced by businesses trying to increase their equity value.

Find out more about the Academy for Chief Executives at www.chiefexecutive.com