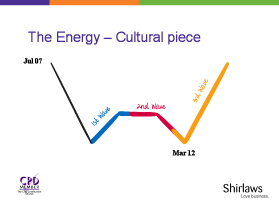

Darren Shirlaw of Shirlaws Global was one of our speakers at the recent RBS hosted Conference ‘Leading Growth’. Darren prepared his clients back in 2007 for the beginnings of a W shaped recession that would last ‘at least 5 years’. We are now in the second dip of that W.

One of Darren’s key points of learning is that recessions are never uniform, so there are always some areas of business doing better than others. The second is that the numbers are always retrospective and that, by the time it is clear that we are in a dip, growth has already started. This is where timing comes in and smart business owners will be planning their growth path even as the general feeling in the media and government (and crucially amongst their competitors) is that we are in a down phase. To join the upturn too late and, worse, to then leave it early means that you might “only get 3 years of growth in a 7 year growth cycle”.

In his ebook, “More money, More time, Less stress”, John Rosling, UK CEO of Shirlaws, looks at actions you can be taking to prepare for recovery. We thank Shirlaws for their permission to use them here.

THE FIVE WAYS TO PREPARE FOR THE RECOVERY

1. Understand Market Cycles

Markets move in waves, with peaks and troughs. There is only one guarantee; that the state we are in now – whether boom times or bust – won’t last forever. Yet recessionary times normally “surprise” most business people.

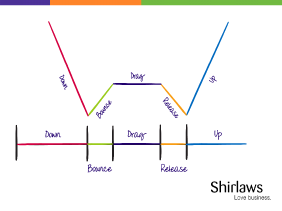

There are four stages in the cycle:

• Down – the economy heads south into a bear market

• Drag – the market bounces off the bottom but drags out in a flat period

• Release – the market spikes downward initially and then releases into a new period of growth

• Up – the market moves into the new bull market.

Understanding the four stages of each economic cycle is the first step to helping you take advantage of the upswing – helping you ‘Catch the First Wave’.

Understanding the four stages of each economic cycle is the first step to helping you take advantage of the upswing – helping you ‘Catch the First Wave’.

Many business owners implement strategies behind these cycles – reacting, instead of getting in front of them. It’s like a surfer who paddles too late – there’s little he or she can do to catch that wave. The opportunity is in seeing how these cycles affect your business and investing accordingly.

2. Timing is Everything

While investing in the markets is instantaneous, investing in business is anything but. After a CEO or business owner decides to expand, such as by adding staff, opening new offices or markets, or investing in new products, these take time (typically nine to eighteen months) to produce a return on that investment.

During a recession, most CEOs and business owners will wait until they have seen the signs of economic recovery before they start to invest in their businesses again. They wait until the markets recover about 30 percent and then reinvest.

Compound the slow start with a lag time between investing in the business and when it starts to pay off, and by the time the growth shows up in the business we may be more than halfway through the next bull run of economic prosperity.

Timing trips up many businesses because owners become more cautious about risk during a recession, and rein in spending and strategic investment. By reducing their appetite towards undertaking risks during a recession, business owners effectively position their businesses to stay behind the curve, missing the first wave of growth.

3. Change Course Nimbly

When a business is in growth mode, we describe this as “winding up”. When a recession hits, businesses start to “unwind”. When the market turns upwards, most owners and CEOs are still operating their businesses with the unwind mentality. With a low risk profile, they are reluctant to let go until there is lots of proof that we are genuinely out of a recession.

The problem is: by the time there is plenty of proof that we are out of the recession and it is safe to invest again, the opportunity is gone as the market will have already picked up 30 percent to 50 percent growth in the initial stages of the new cycle. The opportunity is now – at the bottom of the cycle.

4. See Past the Blind Spots

During boom times, business managers tend to focus on the bigger strategic plays available to them; mergers, acquisitions, new markets, new branches or facilities – the macro strategies. What is forgotten during these times is micro – all of the details that keep the business lean and efficient. Growth during this period will hide these micro mistakes, so during boom times micro is the blind spot in business.

The opposite is true during recessionary periods. Owners tend to get dragged into the details of the business and become very micro-focused. This means the macro strategies and business vision are often overlooked.

Businesses may come out of the recession in one piece, but misaligned or lacking a long-term growth strategy. They then waste twelve months or more aligning the business to grow – but the market is already growing – and they fail to catch the first wave.

5. Work with the Energy

Recessions are made up of more than profit and loss, pounds and pence, facts and figures. The energy and emotions of the market also influence market dynamics.

First, there is fear that drives momentum downward into a recession – without fear, recessions would never happen.

Next, there is the energy of “withhold” as everyone hangs on to everything they have in fear of scarcity. That scarcity results in little energy (which shows up in the form of money) in the system – greatly reduced consumer spending, orders for goods from manufacturers, and capital available for reinvestment.

On the positive side, businesses are forced to re-evaluate, realign their resources and re-jig their product lines. This creates a streamlining effect, increasing efficiency of product and production. Many businesses that make a few changes in this phase find that the tweak creates a substantial, long-term shift in the productivity in their companies.

The recession is nothing more than a cleansing period – it gets rid of the unproductive processes, businesses and people, a bit like a detox.

This provides a strong foundation for new growth, an opportunity for new energy to enter the system, and the perfect time to be ready to ‘Catch the First Wave’.

“Video – The 3 biggest growth opportunities coming out of recession with Darren Shirlaw”

Shirlaws ebooks on the W Shaped Recession and Business Growth are available to download from http://www.shirlawscoaching.com/

Find out more about the Academy for Chief Executives at www.chiefexecutive.com