This is an edited extract from Roger’s monthly update on economic matters worldwide. This extract concentrates on banking and on UK economic matters.

Roger Martin-Fagg

Banks and Banking

The Vickers Report is now going through a consultation period. It quite rightly has said that large integrated banks like Barclays must not use retail deposits to fund risky proprietary trading ( Barclays deny that they do this). We have seen just how risky this can be: Mr Adoboli a trader at UBS managed to lose $2Bn when the Swiss central bank unexpectedly intervened to depress the price of the Franc. UBS has sufficient shareholders funds, (core tier 1) to absorb this loss, so no depositors will lose. However it shows that investment banking has become a casino, and should never enjoy implicit ( via the central bank) or explicit ( via capital injections) taxpayer support.

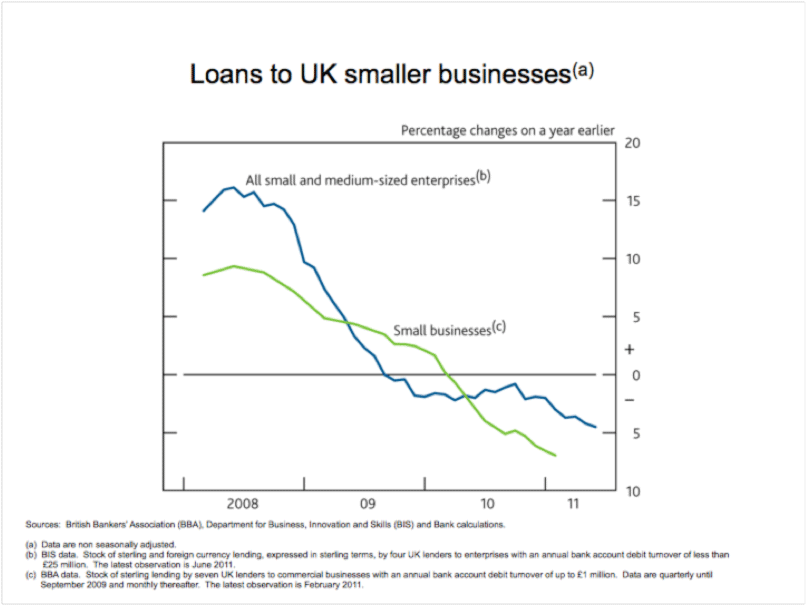

We have another positive feedback loop at work here. Basel 3 and Vickers are are designed to make the banking system safer. But the transition period is actually making things worse. For example the supply of credit to the bedrock of the UK economy, small business continues to fall.

This is partly due to a lack of demand as small companies work hard to reduce their debt, but it is mostly due to an increase in perceived risk in the credit approval systems of banks. The feedback loop is simple, banks are lending less because they see the economy slowing fast, but this makes it worse.

The Bank of England recently published their assessment of the impact of Quantitative Easing. The Bank concludes that QE prevented a double dip, increased inflation by 1.5%, increased household wealth by 16%, increased real output by 2%. Impressive claims. I would argue that middle England has been hurt much more by the 1.5% increase inflation, than benefited from the increase in share prices. Middle England hold few shares, but do own a modest house. I see no evidence that wealth has increased for this the dominant source of demand in the economy. I see the reverse, real incomes and real spending is falling. But I guess the Bank is trying to make the case for another round of QEW later this year.

The UK Economy and its prospects

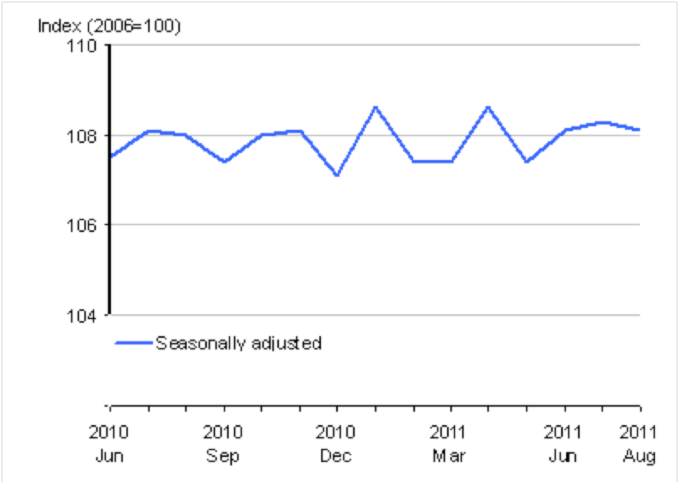

The immediate outlook is poor, unless fuel and food prices fall significantly in the next three months. Household real incomes are falling by nearly 3% year on year. This is reflected in retail sales data: sales volumes are flat. We will experience a mild double-dip at the end of this year, the economy will shrink about 0.7% in real terms. Many will not even notice it, but the political impact could be considerable with the opposition claiming it could have been avoided. This isn’t true, but the point will be made ad nauseam. Base rate will remain at 0.5% for another 12 months at least.

UK Retail Sales

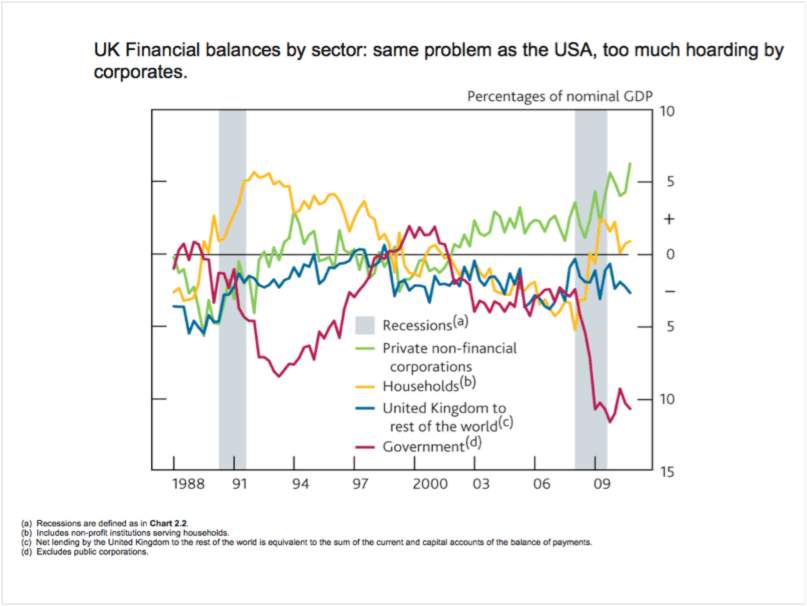

As I have said before, the problem is corporates hoarding cash. Good for them, bad for the system. Western Governments cannot do anything about this apart from taxing cash holdings which I wouldn’t advise!

Please note that Government sector deficits are the mirror image of Private sector surpluses. There is yet again a feedback loop in operation: USA companies are holding on to cash because they see Congress divided and not in control of things, they see a weak President, they see an increasing number of opportunities to purchase weaker competitors at fire sale prices and finally they note that the prospects for domestic demand expansion are poor. The Obama incentives to hire more workers will fail, instead it will increase Private sector surpluses and the Government sector deficit. Most companies employ more people when the order book is growing fast and it exceeds existing capacity. Reducing payroll taxes just allows companies to increase their cash balances.

Conclusion

The global economy will slow down to about 3% yoy growth as Brazil, India, China reduce their inflationary growth rates. Europe will stagnate with zero growth. The UK will have a mild double dip, and probably the USA too. If the oil price drops to $90 or below, Russia will slow down significantly, but the USA will avoid double dip. Over the next five years we can expect a sawtooth pattern for GDP in the West with sustained growth not returning until circa 2015.

How to survive and expand your business under these conditions? Keep it simple, communicate with and motivate your employees, pay them what you can afford, find out what two or three things make the biggest difference for your customers, and deliver them consistently. Have fun!

Roger has facilitated main board directors and senior managers through a strategic review process, which he continuously updates. In this way he has worked for Taylor Wimpey, Experian, Brent International, Marshall Cavendish, Elga Pure Water, DHL Czech Republic, Marks and Spencer, Tribal, and Technicolor. He also regularly gives economic updates to groups of Chief Executives of SME’s at seminars round the UK. His book ‘Making Sense of the Economy’ is in its third reprint. His hobbies are rowing and playing piano in a Blues Band.